Total ITV Studios revenue grew 3% to £893m (2024: £869m), in the first six months of this year, at the same time as Earnings Before Interest, Taxes, and Amortization (EBITA) fell by 21% from £136m in 2024 to £107m.

Revenue from domestic commissions declined by 13%, without ITV’s Saturday Night Takeaway, and compared with the increase sports production revenue from the 2024 Men’s Euros. However, this was balanced with growth from international work, which was up 11%.

ITV stated that the lower EBITA “reflects the weighting of revenue, profit and margin to H2 as previously guided due to the phasing of high margin productions and distribution being weighted to the second half.”

ITV Studios delivered shows including Sneaky Links: Dating After Dark for Netflix, Code of Silence and Shark! Celebrity Infested Waters for ITV, and Love Island USA for Peacock.

Earlier this year, ITV acquired independent scripted producer, Moonage Pictures, producer of The Gentlemen and A Good Girl’s Guide to Murder.

Newly launched digital hub Zoo 55 “made excellent progress in the first half, as we maximise the monetisation of our high-value content library through digital distribution.”

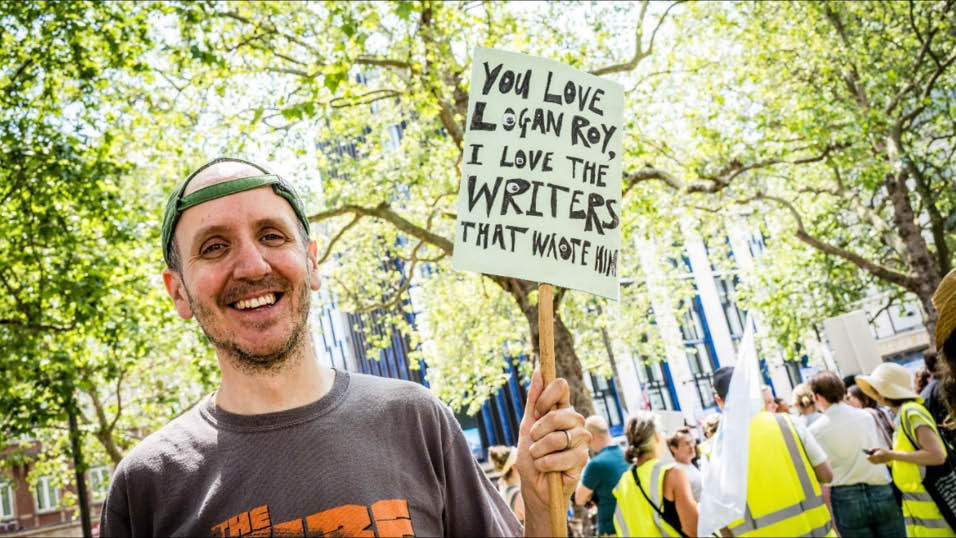

ITV says it is still on track to deliver its target of total organic revenue growth of 5% on average per annum from 2021 to 2026 – ahead of the market, and at a margin of 13 to 15%, although at a lower level than 2024, down to the market recovery after the 2024 strikes.

Growth is driven by revenue from international commissions, with key programmes such as Rivals S2 for Disney+, The Reluctant Traveller S3 for Apple TV+, Gomorrah – Origins for Sky, and Love Island: Beyond the Villa for Peacock in the US.

ITV Studios first half reporting reflects the story for the whole ITV Group, where total group revenue fell by three per cent, to £1.848m, with group adjusted EBITA down by 31% to £145m. , “ahead of market expectations.”

The broadcaster says that “performance is ahead of market expectations as we continue to successfully execute Phase Two of the More Than TV strategy, including the expansion of our UK and global production business in ITV Studios, supercharging our streaming business, ITVX and optimising our highly cash generative linear broadcast business.”

ITVX digital advertising revenue is up 12% compared to 2024.

ITV has also announced an additional £15m in “permanent non-content cost savings,” taking the total group permanent non-content savings in 2025 to £45m.

Total content spend is predicted to be around £1.23bn in 2025, compared to the £1.25bn previously indicated.

“While the economic environment remains uncertain, we now expect a better outturn for the full year 2025, driven by these cost efficiencies.”

Pippa Considine

Share this story